When reliability is key, choosing a Sennebogen is a must. SYNETIQ, the largest salvage and vehicle recycling company in the UK, has invested in a new Sennebogen 830 E scrap handler supplied by Molson Green.

SYNETIQ has been on a remarkable growth trajectory since it launched last year. Now arguably the largest business of its kind in Europe, SYNETIQ has sites positioned throughout the UK, including the impressive 27-acre site on Bentley Moor Lane in Doncaster that is home to their new Sennebogen 830E.

Sennebogen recently visited the flagship Doncaster site to meet with SYNETIQ Operations Director, Ray Curry, to understand how the business operates and why they have chosen to go with a Sennebogen 830 E supplied by Molson Green.

Ray describes the baling plant at the flagship Doncaster site as the “beating heart of the business”, with approximately 80% of the vehicles being handled by the Sennebogen as they are put into the bailer and subsequently loaded into articulated wagons. Ray went on to say; “On a busy week the bailing plant can process around 700 vehicles. With that sort of throughput, the reliability of our plant and machinery is key. With lorries constantly delivering new stock and taking away processed vehicles, a breakdown can easily cause our operation significant problems”.

“Although we had previously been purchasing scrap handlers manufactured by another brand, we have had experience of the Sennebogen products at one of our legacy businesses prior to the merger. The big green machines had proven to be a dependable member of the team, so after looking at the huge range available we decided to speak to Molson Green about a potential new machine.”

“I have to say that the team at Molson Green where very knowledgeable and easy to deal with. Following a few conversations and a visit to our facility, we established which machine would best suit our requirements and a demo machine was on its way for our operators to put it to the test… a test that it passed with flying colours. The Sennebogen delivered on all the things we knew it would from the spec sheet; such as reach, capacity and power, but it was the operator feedback on comfort of the cab, visibility and smoothness of control that made it an easy choice to make. Our operators where such a fan of the machine it never left the yard”.

The Sennebogen 830E that SYNETIQ decided to go with, offers an impressive 17m reach (measured from centre of slew ring to stick pin) from the K17 boom and stick. Using the four stabilisers to raise the wheeled undercarriage off the ground, the operator can remain in one location and take the stripped vehicles, load them into the bailer, stockpile them once processed and even load incoming waggons without having to move.

To assist operators in completing tasks more efficiently, this 830E has a high-rise cab, with additional screen and roof protection allowing the operator’s eye level to raise up to approx.5.65m. The operator can then see clearly into trailers when loading ensuring the load is filled to maximum capacity and with a greater degree of accuracy.

Inside the cab, the operator has an uninterrupted forward view thanks to the Sennebogen’s joystick steering. The benefit with joystick steering is there is no bulky steering column blocking the operators view to the ground where the majority of sorting is completed in this application.

Machine access and operator daily checks are also very straightforward. The factory fitted 3-point access steps and ladders along with the upper carriage “boxing ring” giving the operator a safe and secure area to work in. The daily checks can be done from ground level and the centrally mounted grease points for the undercarriage, autolube on upper carriage mean there is no requirement to crawl under the machine.

Molson Green Sales Manager, Dave Peacock said; “Ray and his team where very clear from the outset on what the machine had to do and made it very clear to me how we had to support them as a dealer. Any concerns about the after-sales backup support from Molson where quickly addressed when we discussed our 10 service locations, significant stock holding of spare parts and the network of over 75 service engineers.

Dave went on to say; “When you are dealing with machinery, a problem at some point down the line is inevitable, but it is the way you deal with it that counts. The Sennebogen product is well known in all their key industries as one of high quality and reliability, and Molson have backed this up with recent investments in our back-end IT structure and additional service locations. We are now a true nationwide service provider which means that we are incredibly well placed to support all customers from a one site operation, through to a business on the scale of SYNETIQ”.

Ray continued this point by saying; “As you would expect we haven’t had a problem with the Sennebogen yet and I have faith in the machines build quality to think that we won’t for some time to come, but having the support of a business like Molson means that we can be sure that our business won’t grind to a halt in the event of a breakdown. The fact that Molson continued to support their customers working in key industries such as waste and recycling throughout lockdown shows me that they are as committed as we are”.

During the Coronavirus pandemic, SYNETIQ received key worker classification from DEFRA. The business put a proportion of its workforce on furlough to reflect the initial downturn in demand at the start of lockdown, as well as to ensure a safe (socially distant) working environment could be provided for those workers who remained. This period offered opportunity for SYNETIQ to consolidate some of their satellite sites’ operations and make major improvements to their facilities, as well as having a good clear out of older stock.

Ray went on to say; “The biggest change to our business driven by the COVID crisis has been in our Green Parts operation. We took the decision to close our customer counters, reducing the risk for our colleagues and walk in customers alike. This left us with MyGreenFleet (a green parts procurement platform), our eBay shop and our website to generate all the sales of parts. With a reduction in employees in our call centre, we turned to technology to help us meet customer demand. We have introduced webchat and been able to increase the sales from our website, whilst operating with approximately 50% of the usual team dealing with enquiries”.

The Advanced Leadership Program is a high-impact and challenging developmental experience for elite female leaders. Over a career-defining, twelve-month journey, participants engage in a deep exploration of their own strengths and weaknesses as they relate to building and leading highly effective organisational communities.

FINAL CALL: UP TO £2,500 AVAILABLE FOR WOMEN'S LEADERSHIP DEVELOPMENT

Women currently working in the Automotive sector have a final opportunity to register their interest in a scholarship worth up to £2,500 to support participation in an accredited leadership development program.

Funding must be apportioned by the end of February and it is unsure when these grants will be available again. Find out more and register your interest by completing the Expression of Interest form here prior to 5pm on 14 February:

https://www.womenandleadership.org/automotive

Changes to Value Added Tax regulations in Germany

Due to a law change in Germany on January 1, 2019,

- eBay may be liable for the unpaid VAT of its sellers

· eBay will have to collect a certificate (“Bescheinigung nach §22f UStG”) from each business seller, which confirms the tax registration of the seller.

Please note that a tax clearance certificate from the tax office is not sufficient. Required is a "certificate according to §22f UStG"..

Also note:

- Tax evasion is a criminal offence. eBay continues to work with German authorities to prevent it and will take action against those who don’t comply with the law. This includes but is not limited to listing removal and account suspension.

| Submit your certificate now. Waiting leads to longer processing times! |

Who is liable for VAT in Germany?

In principle, it is not relevant on which local eBay site a seller lists his item.

Typically, a seller needs to register for VAT if they meet one of the 3 conditions:

· You are a seller established in Germany.

· You are selling goods that are warehoused in Germany.

· You ship goods to private individuals in Germany from a foreign EU country where the goods are stored or delivered in advance. This applies for a total German turnover of 100,000 euros per year across all sales channels.

For any further questions, please contact your tax advisor.

Next steps

If you fulfill any of the 3 criteria, you should check whether you are complying with your value added tax (VAT) obligations as soon as possible.

1. Check whether your business needs to register for German VAT.

- If so, register with the German tax authorities and apply for a VAT identification number. In addition apply for a VAT certificate (Bescheinigung nach §22f UStG).

3. Enter your VAT identification number on eBay, so we can display it on your eBay.de listings (as required by the law)

- Check that your business name and VAT identification number in your eBay account matches those on your VAT certificate (Bescheinigung nach §22f UStG). Also, please make sure that your certificate carries an official stamp by your tax office

5. Upload your certificate (Bescheinigung nach §22f UStG). .

If you are affected, you should request the certificate (“Bescheinigung nach §22f UStG”) as soon as possible, as the tax offices can quickly reach their capacity.

You have to upload your certificate to eBay on time in order to continue selling on eBay.

Due dates:

· 1 March 2019 - Business sellers outside the European Economic Area (EEA)

· 1 October 2019 - Business sellers within the European Economic Area (EEA

Information from the German tax authorities for countries outside the EU

To learn more about VAT for businesses not established in the EU, please visit::

FAQ's

How can I find a tax advisor?

There are several options to find a tax advisor which could help you going forward.

- Ask your local tax advisor (or lawyer, accountant) if they can recommend a firm in Germany e.g. from their network

- Search for a tax advisor in Germany (“Steuerberater”, “Steuerberatergesellschaft”) based on the respective needs

- Language skills

- Tax area (“Umsatzsteuer” (VAT))

- Experience with clients trading on eBay

- If you are subject to a criminal investigation due to unpaid taxes, consider looking for a “Steuerberater” or “Rechtsanwalt” with focus on “Steuerstrafrecht“ or “Steuerstrafverfahren”

- You can use the nationwide Tax Advisor Search (Bundesweiter Steuerberater-Suchdienst)

- In the section – “Arbeitsgebiete” (Field of activity) you can select the below:

- VAT – “Umsatzsteuer”

- Penal proceedings for tax fraud and other tax offences – “Steuerstrafverfahren”

- In the section “Branche” (Industry) you can select the below:

- E-commerce – “Internethandel”

- B2C trading – “Business-to-Consumer-Handel”

- In the section “Fremdsprache” (Language skills ) you can select the below (to be localized according to the site) for example:

- English – “englisch”

What is the difference between a German national tax number and a VAT identification number

If you register your business in Germany with your local German tax office, you receive a national tax number (“Steuernummer”) from that tax office. In most cases you will be given one tax number for all types of taxes your business is obligated to register for, e.g. VAT. The tax

number is used for any communication with the tax office.

The Tax number is between 10 and 13 digits long and only consists of numbers, some separated by “/”.

German VAT identification numbers start with “DE” followed by 9 digits (numbers).

I have multiple ebay accounts. Do I need a certificate for each account?

You must upload a certificate for each of your eBay accounts. Please check whether the data of your company on the certificate ("Bescheinigung nach §22f UStG") matches the data in your eBay account.

How can I add my VAT identification number to my eBay listings?

If you are liable for VAT in Germany and have a VAT identification number, the law requires that your VAT identification number is displayed on all of your listings (§ 5 TMG). Please enter it beneath and we will display it for you:

Do I have to provide the German national tax number at eBay?

In the future, it will be necessary to provide your tax number on eBay.de as well.

Please note that this information is only general information and cannot replace legal or tax advice.

If you have further questions, please contact an attorney or other legal and/or tax advisor.

SYNETIQs Police auction: register for free today

Trade sales can be a fantastic route to a great value vehicle… SYNETIQs Police Auction is exactly that. Log on to the site and you’ll find hundreds of vehicles live on the site, with the virtual hammer prices at a fraction of what you’d expect to pay.

How does it work?

SYNETIQ is the UKs largest salvage and dismantling company. It has contracts with many insurance and fleet companies, as well as many UK Police Forces - this is where Police auction items come from.

The Police auction was relaunched last week on a new dedicated platform in tandem with SYNETIQs main salvage auction, which has thousands of vehicles listed six days a week.

How much does it cost to register?

Unlike SYNETIQs main auction, registration for the Police auction is free. Once you’ve registered, you’ll need to upload proof of identification before you can bid. This ID must be approved by a member of SYNETIQs team, so leave plenty of time for this if you’re keen to bid on a vehicle.

For more information, or to register on the Police auction click here: https://www.police-auction.org.uk/

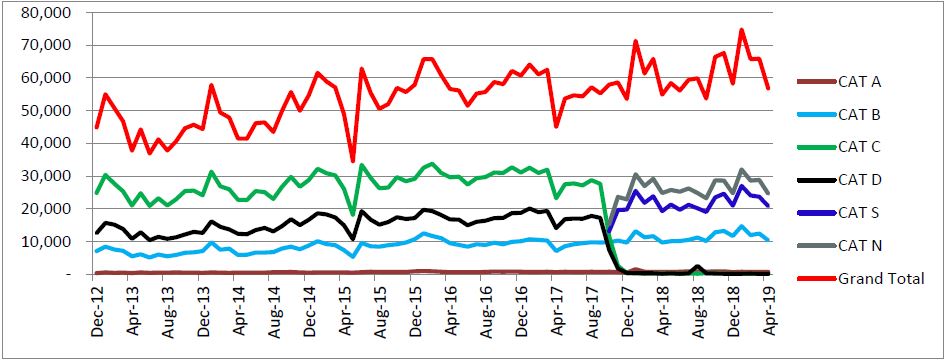

Following the email to the membership recently regarding a FOI request to DVLA relating to Salvage Categories by numbers over the last few years please see below for this information graphically

Page 10 of 10